In our contemporary, fast-moving society, the availability of swift and convenient loans can serve as a financial lifeline for countless individuals. Whether you’re embarking on a business venture, confronted with unforeseen medical bills, or seeking relief from burdensome high-interest debts, mastering the art of successfully applying for a hassle-free loan is paramount. This comprehensive article is here to steer you through expert tips, ensuring an enhanced likelihood of promptly securing the loan you need, with minimal effort.

Read more.. Adani Power to Adani Enterprises — Adani Shares Fall

Read more.. Warren Buffett’s 93rd Birthday: the Investment Sage’s

1. Understand Your Financial Situation

Prior to immersing yourself in the loan application journey, it’s imperative to grasp a comprehensive comprehension of your financial standing. Assess your earnings, expenditures, and outstanding liabilities meticulously. This exercise will not only enable you to ascertain your borrowing capacity but also furnish valuable insights into your creditworthiness, a pivotal determinant in the loan approval equation.

Raed more.. CK Aeroflex Industries IPO: How to Check Allotment Status

Read more.. Navigating the Terrain of Quick Loans Online in India

2. Check Your Credit Score

Your credit score plays a pivotal role in the loan approval process. Lenders use it to evaluate your creditworthiness Certainly, securing a copy of your credit report and diligently inspecting it for inaccuracies or inconsistencies is a crucial step towards enhancing your creditworthiness; should you encounter any discrepancies, it is imperative to rectify them promptly to bolster your credit score effectively.

3. Research Lenders Thoroughly

Lenders differ significantly in their propositions and standing, emphasizing the importance of dedicating time to explore a wide spectrum of choices, ranging from traditional banks and credit unions to online lenders and peer-to-peer lending platforms, to ensure a well-informed choice. Meticulously assess their interest rates, loan terms, and customer reviews to pinpoint the ideal match for your specific financial requirements. Opting for the perfect lender can be a pivotal factor in determining the outcome of your loan application.4. Choose the Right Loan Type

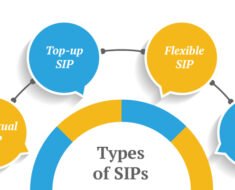

A diverse array of loan options awaits, including personal loans, payday loans, and secured loans, each tailored to distinct needs and accompanied by unique terms and interest rates; selecting the loan type most aligned with your financial situation is paramount.

4. Prepare Necessary Documentation

Lenders will require certain documents to process your loan application To expedite your application, ensure you have all the required documents ready in advance, which usually encompass proof of income, bank statements, identification papers, and occasionally, collateral documentation.

5. Maintain Stable Employment

Stability in your employment history can boost your chances of loan approval. Lenders prefer borrowers with a steady source of income. If possible, avoid changing jobs in the months leading up to your loan application.

6. Demonstrate Repayment Capability

Lenders want to be sure that you can repay the loan. Be prepared to provide a clear repayment plan, including how you intend to cover the monthly installments. A well-thought-out plan can instill confidence in lenders.

7. Avoid Multiple Loan Applications

Submitting multiple loan applications within a short period can negatively impact your credit score and raise red flags with lenders. Be selective and apply to the lenders that best match your needs to minimize the risk of rejection.

8. Seek Professional Advice

If you’re unsure about the loan application process or have a complicated financial situation, consider seeking advice from a financial advisor or credit counselor. They can provide guidance tailored to your unique circumstances.

9. Be Patient and Persistent

Lastly, don’t be discouraged by rejection. If your loan application is denied, ask the lender for specific reasons and work on improving those aspects of your financial profile. Persistence can pay off in the long run.

Conclusion

Always keep in mind the importance of comprehending your financial standing, upholding a stellar credit history, making informed decisions when selecting a lender and loan product, and ensuring you furnish all essential paperwork. By adhering to these fundamental guidelines, you’ll pave a smooth and swift path toward securing the necessary loan.