In the era of digital convenience, managing your investments has never been more straightforward. The advent of investment apps allows individuals to take control of their financial futures with ease, all from the palm of their hand. Whether you’re a seasoned investor or just beginning your investment journey, a wealth of investment apps awaits your consideration. In this comprehensive guide, we’ll explore some of the finest investment apps available, each offering efficient solutions for the creation and management of your investment portfolio.

Robinhood

Robinhood has taken the investment world by storm, lauded for its user-friendly interface and groundbreaking commission-free trading. This innovative app empowers users to invest in a wide array of financial instruments, including stocks, options, cryptocurrencies, and exchange-traded funds (ETFs). Furthermore, it offers a customizable news feed and delivers valuable market insights, equipping investors to make informed decisions.

Read more.. How Much Is Renters Insurance? 2023 Rates

Read more.. The Best Pet Insurance Companies in the USA

Acorns

For those looking to initiate their investment journey without substantial initial capital, Acorns stands as an ingenious solution. This micro-investing app rounds up your everyday purchases to the nearest dollar and automatically directs the spare change toward your investments. It’s a simple and effective way to commence saving and investing without even realizing it.

Read more.. Best Pet Insurance For Pre-Existing Conditions

Read more.. What Does a Pet Dog Insurance Plan Cover?

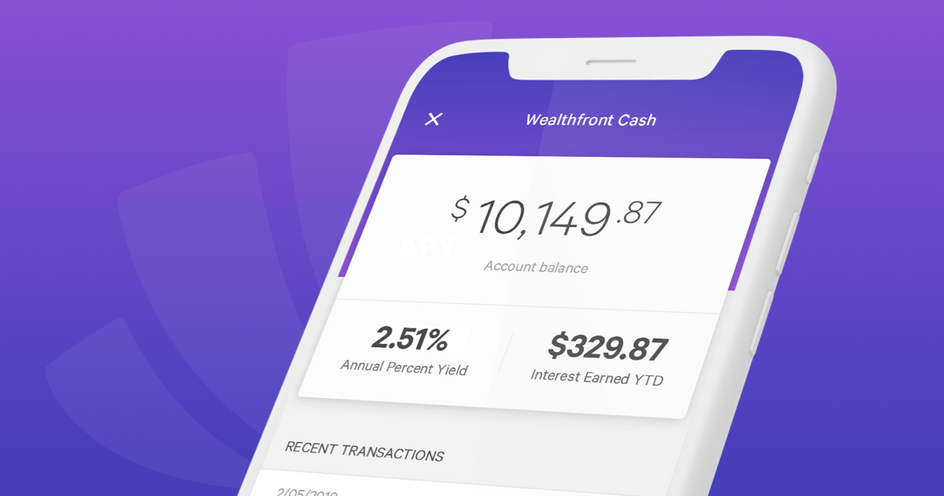

Wealthfront

Wealthfront operates as a robo-advisor, providing automated and cost-effective portfolio management. This platform expertly constructs a diversified portfolio tailored to your risk tolerance and financial objectives. Wealthfront stands out as a top-tier choice for investors who lean toward a hands-off approach to managing their finances, thanks to its impressive array of features, including tax-efficient investing and daily portfolio rebalancing.

E TRADE

E TRADE, a well-established platform, offers an extensive suite of investment tools and resources. Users can seamlessly trade various financial instruments, from stocks and bonds to options and mutual funds. The app also provides a plethora of educational materials and research, making it the ultimate choice for individuals eager to expand their financial knowledge.

Stash

Stash simplifies the investment process by breaking it down into easily digestible options. This app allows users to invest in themes and sectors that align with their interests, whether it’s clean energy, technology, or healthcare. With a low minimum investment threshold, Stash ensures accessibility for everyone, offering an opportunity to embark on their investment journey.

M1 Finance

M1 Finance bridges the gap between automated investing and personalization by allowing users to choose from pre-constructed portfolios or design their own. Remarkably, it offers these services without charging commissions or management fees.

Vanguard

Vanguard is renowned for its low-cost index funds and ETFs. The Vanguard app grants access to a wide array of investment options, including retirement accounts. If you prefer a straightforward, long-term investment strategy, Vanguard stands out as a top choice.

Ally Invest

Ally Invest distinguishes itself through competitive pricing and a user-friendly platform catering to beginners and experienced traders alike. With a comprehensive toolkit and a wealth of resources at your disposal, Ally Invest offers a seamless trading experience and access to a diverse range of investment vehicles.

Conclusion

The selection of the ideal investment app for your portfolio hinges on your unique financial goals, risk tolerance, and personal preferences. Whether you favor hands-on trading or opt for a more hands-off, automated approach, there’s an app tailored to meet your specific requirements. While these apps provide convenience and accessibility, diligent research, diversified investments, and staying informed about market trends remain essential. Armed with the right investment app and a well-considered strategy, you can steer your financial future toward success, witnessing your investment portfolio flourish.